– Do you have questions regarding a cell tower lease buyout and want advice from an industry expert?

– Are you considering selling your lease and want to make sure you get the highest sales price?

– Do you want to ensure you rights are adequately protected by a consultant with the proper legal background?

Having closed over $50,000,000 in lease sale transactions, the experts at Tower Advantage can provide you with a superior level of advocacy that you deserve and require. When securing the largest offers for our clients, we solicit both public and private investors to ensure the most competitive process. This helps ensure you are not leaving any money on the table. In addition, we will negotiate the best language to protect our clients from many unforeseen obstacles.

Please feel free to contact us today for your free initial consultation. We also suggest reading the 10 Factors to Consider When Hiring a Cell Tower Lease Consultant.

What is a Cell Tower Lease Buyout?

This is when a landlord decides to sell his lease along with the rights to receive the future rental income for a certain period of time. This time frame can be in perpetuity, or for some shorter period such as 99 years, 50 years, etc. The buyer will make a lump sum payment – or several installment payments – in exchange for the right to receive the future rental income for that period of time.

What Should You Do When You Have Been Contacted For A Cell Tower Lease Buyout?

First, do not “blindly” believe companies looking to purchase your lease – whether it is your current cell tower tenant or any other third-party buyer. As you can imagine, they are trying to maximize their profit, so the lower they can get you to sell your lease, the more money they can make. That is where having an independent cell tower consultant with the proper legal and business expertise can provide you with the input you need.

Step 1: Don’t “Blindly” Believe The Companies Looking To Purchase Your Lease – Many of Them Cannot Be Trusted

A buyer who wants you to sell them your lease will often tell you whatever they believe will get you to sell it to them – and quickly! We have heard many examples of these misrepresentations from our clients over the years.

They Will Tell You Anything To Get You To Sell Your Lease

Some companies may try to tell you that you need to sell them your lease because the tower is not going to be there long-term. Ironically, they still want to purchase it despite that fact. Of course, they come up with all sorts of reasons to make you believe it.

They will give you reasons such as they can afford losing the rent if the site was terminated because they own many sites across the nation and it would not affect them. If someone is telling you that you have a “bad apple”, what sense does it make that they want to purchase it? It doesn’t!

Don’t Believe The “Marketing” Line

Other buyers will tell you they can bring you more income in the future if you sell them your lease. They say they will “market” it, but they just need additional land so they can share that additional rent with you. Instead, they are just taking more money out of your pocket.

First, most do not market it since they do not own the actual tower and would not get any benefit with the addition of a new subtenant. Secondly, if a new subtenant needed additional land from you for their ground equipment, you would get 100% of that rent without having to share it with anyone.

Get More Answers

These are quick explanations to complex issues. Consequently, feel free to contact us anytime for your free consultation so we can explain to you the specific reasons, so you do not get misled by these unscrupulous “predators”.

Step 2: Seek a Cell Tower Lease Expert to Provide You With the Proper Representation

Tower Advantage is not just a cell tower lease expert. We have the legal background that you require in order to properly negotiate the sale of your lease. A lease buyout agreement is written by the buyer’s attorneys to maximize the rights and lessen the obligations of the buyer. We will not simply focus on the economics of the deal, but rather, the entire agreement to make sure that you are adequately protected.

Tower Advantage Has Legal Expertise

A typical cell tower lease buyout includes a letter of intent and/or a purchase and sale agreement; an easement agreement; and several other legal documents. There are many provisions that can negatively affect property owners if they are not sufficiently addressed. Our experts have negotiated hundreds of lease sale transactions and can properly advocate for your rights.

“…Tower Advantage got us an offer significantly higher than the one we had received, even after their fee. The process was made simple for us since Tower Advantage negotiated the purchase offer and closing documents. This saved us time and money since we did not need to hire a separate attorney to ensure that our rights were not being overlooked.” – Pastor Bob L. [read more]

We Have a Unique Way to Solicit the Highest Offers

Tower Advantage will solicit the largest purchase price in the industry by using a “bidding-type” approach. We highlight the most important factors in your lease agreement that will secure the largest prices. With access to more buyers – both public and private – it creates more opportunity for us to create value for you.

We Are Incentivized To Maximize Your Opportunity

Tower Advantage only earns a fee if we secure our clients the largest purchase price for their particular situation. As a result, we are incentivized to produce the best results possible for our clients. Moreover, we can typically get much higher prices with the same companies that have already contacted you, so you have nothing to lose. To date, our experts have used this approach to successfully complete over $50,000,000 in lease buyout transactions.

Contact us if you would like us to provide you with a free review of your situation. As we like to say, we would be happy to provide you with the Tower Advantage.

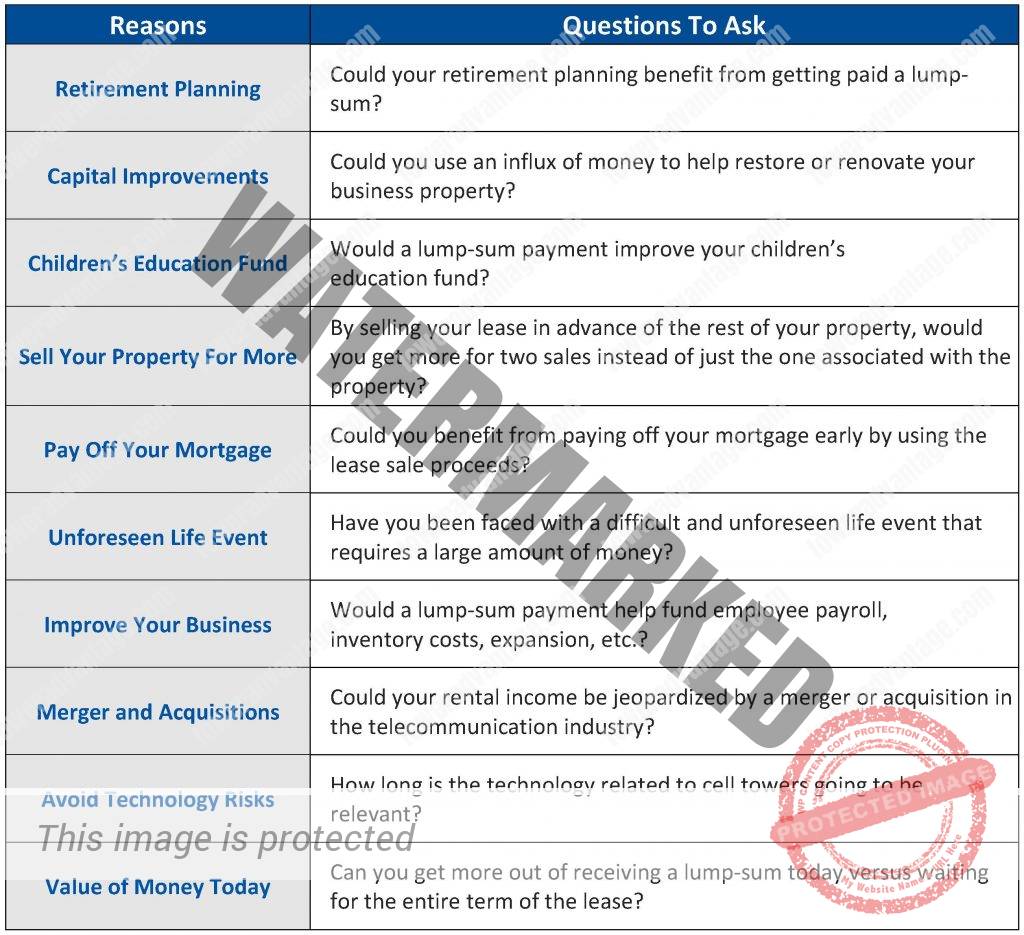

Some Reasons Landlords Consider a Cell Tower Lease Buyout

There are many reasons it may make sense to sell your cell site lease. Tower Advantage has put together some basic considerations below which can help you determine if selling your lease is the correct decision. You can also check out the following article that provides more information on these 10 Benefits of a Cell Tower Lease Buyout:

What Are the Other Important Considerations in Selling Your Lease?

A cell tower lease buyout is a complex transaction. There are many important ways that our experts will provide you with superior value as compared to others in the market. Below are just some of the questions that we will be happy to answer for you in more detail when you contact us for your free initial consultation:

What Is My Cell Tower Lease Worth?

A buyer that is looking to purchase your lease will base its worth on a variety of key factors.

Primary Factors

The primary factors include the current rent, the amount and time period of future rent increases (aka escalators), the lease expiration date, and the potential for sharing in subtenant rent. Of course, there are other factors as well, but these are some key considerations that buyers will use to discern the value they place on the asset.

Length of Purchase Term

Typically, the longer the purchase term, the higher the value as well. Terms can range from perpetuity, to less than 20 years. However, if you are looking to maximize your dollar amount, the longer is normally better. That is because the more time the buyer has to receive the rental income into the future (assuming cell towers are still needed), the more money that they will pay you for the cell tower lease.

Tower Advantage Can Maximize The Value

Since Tower Advantage completes millions of dollars of cell tower lease buyout transactions on a yearly basis, our clients benefit from that extensive transactional experience. For instance, we can often secure purchase terms for shorter time periods, but at the same price as what you could obtain for 99 years or longer. Although you may not be around that far into the future, it can provide your heirs with valuable income far sooner than they otherwise would receive it.

Should I Consider an Installment Buyout Offer?

At first glance, installment offers can appear that you will actually get more for the sale of your cell tower lease. Yet, you have to ask yourself what is the reason the same buyer would offer more for the same rights. When you understand the answer, it makes sense why the lump-sum buyout is likely the better choice.

The “Real” Dollar Amount Is Less With an Installment Offer

The answer is that it comes down to basic economics. When calculating the “real” dollar amount, a buyer is considering interest, inflation, and its use of the money until it has to pay you the total sales price. After factoring in those issues, the actual value of the installment amount is normally less than a one-time payment at the close of the transaction.

Contact Tower Advantage and we will be happy to review the installment offer that you have received to provide you with an in-depth analysis of your options.

How does a Right of First Refusal (ROFR) Affect My Value?

Many cell site leases contain a provision entitled a right of first refusal (ROFR). This ROFR allows your cell tower tenant to match any offer you receive in the marketplace. It seems harmless enough, right?

Many Buyers Won’t Make Purchase Offers On Leases With ROFRs

There is an “unspoken” agreement between many buyers in the industry to avoid making offers on cell site leases that contain ROFRs. But why exactly? The reason is one of reciprocity.

Those buyers do not want their competitors to bid on their cell site leases with ROFRs, and they won’t bid on their competitors. Cell tower tenants want to avoid paying a premium for their own leases, especially if they do not have to. However, they will do so in order to protect themselves from competitors that may subject them to future rent “hikes” or less favorable lease provisions. Consequently, by some buyers agreeing not to make offers on their competitor’s leases that contain ROFRs, the property owner will get less offers for the “real” value.

That Doesn’t Stop Tower Advantage From Securing The Highest Offer

Tower Advantage has access to every type of investor in the marketplace – both public and private. By having this network, we can secure the highest price for your lease regardless of whether it “offends” your cell tower tenant. That way, you do not have to worry about receiving less than you should for your valuable asset. Without this network at your disposal, most landlords can be certain that they are leaving “money on the table”.

For more information on ROFRs, please feel free to contact us anytime.

Am I Selling My Land When I Sell My Lease?

No – a cell tower lease buyout is not a sale of the entire property. At a minimum, the purchaser of the lease will receive only an assignment of your cell tower lease. If the landlord wants the highest price possible, the buyer will need an easement as part of the purchase (discussed below).

Is an Easement Required?

An easement is not necessarily required, although without it, the lease buyout company is subject to losing their investment. An easement is a right to use the property for a specified purpose. Buyers are purchasing a telecommunication easement to operate and access the property where the cell tower is located. By having one, the buyer can make sure that if the current lease expires or is terminated, they can try to get another tenant on the property. Without it, as soon as the current lease is over, so is their investment.

Does a Cell Tower Lease Buyout Devalue My Property?

It depends on a variety of factors, including the type of property that you own. Many times the sale of your lease can actually increase the value. This is because a buyer of the entire property will not normally put the highest value on the cell tower income. By “separating” the lease from the rest of the property, lease buyout companies can pay you a premium for that asset whereas a normal buyer would not.

Do I Need an Attorney To Review My Cell Tower Lease Buyout?

An attorney is never required, even – as they say – when you are representing yourself in court. Tower Advantage was founded by an attorney who has been helping property owners for over 20 years. We provide the legal expertise that you require when considering a cell tower lease buyout.

Most lease buyout agreements contain over 30 sections drafted by the buyer’s attorneys. Since most consultants do not possess the necessary skills, credentials, or licensing, they cannot help you negotiate these agreements. Please contact us today to make sure that you are getting the full-service representation that you require.

What Do Interest Rates Have To Do With My Sales Price?

As many of us are aware, when interest rates are low, the cost of capital is less expensive. Conversely, when interest rates are high, the cost of capital is more expensive. Due to the Federal Reserve’s federal funds rate continuing to be at historic lows, purchase offers for cell tower leases have been at historic highs. This will not always be the case. As interest rates rise, the offers will tend to go in the opposite direction as the cost of capital rises.

Can I Do a 1031 Exchange?

Yes, you can. The term 1031 Exchange is defined under Section 1031 of the IRS Code. A 1031 Exchange allows a taxpayer to exchange one investment for another while deferring the tax associated with the sale. In order to learn more about how we can help you structure your transaction to include a 1031 Exchange, please contact us today.

Am I Missing Anything?

There are many things to think about when you are considering a cell site lease buyout. We recommend that you seek a qualified expert prior to moving forward with any agreement related to your cell tower. The experts at Tower Advantage will be happy to make sure you are not missing anything!

Contact Tower Advantage today for your

free consultation on a cell tower lease buyout.

(833) MY-TOWER

(833) 698-6937

![]()